- Know that you are not alone

- Educate yourself on debt management

- Accept that your lenders don’t give a fuck about your intentions

- How do you motivate yourself and start thinking about paying off your debts?

- Put down all your Money stress on a notepad

- Change your belief about Money

- Be honest and discuss your debt stress with your family

- Understand your needs , wants and prepare a Budget Tracker

- Stop borrowing any more money and start saving

- Build a side hustle

- Learn to unlearn your old buying habits

- Stay true to your imagination

Every time I meet a friend or someone who has money stress, I ask them to imagine this. Imagine that you have several income sources and a job that you love where you get incentives every week and bonuses every month.

They laugh and say I can’t imagine this.

I then ask them to think about what they would do if they had all the money in the world.

The first thing they say is, “I would pay off my debts. “

The reason I am sharing all my learnings in this article is to help anyone who is experiencing serious Money stress due to debts, losing hope, and does not know what to do next or how to become debt-free in a world where there is no support available for anyone who is in debt.

1. Know that you are not alone

Five years ago, I thought my life would look different money-wise and I would be in a more secure space, but then the pandemic hit, and I ended up landing a medical emergency in my family and getting buried under an avalanche of debts.

I thought next year would be better. I did my best to break the money stress however while recovering from the medical bills debts, I made a bad investment and put myself in a situation where I was forced by my debts to live paycheck to paycheck.

I know we are born to be free; stress-free, worry-free, and not screwed by societal expectations and culture of how to manage our money and live a life that is acceptable or only a show-off lifestyle. But certain situations are not in your hands at times, and you may have to borrow money from lenders. In my case, it was a medical condition of one of my closest family members.

I want you to know that no matter what your situation was or is due to debt stress, You are not alone.

Finding the right support, resources, and advisors is the most important step in your journey to becoming debt-free. You are already hopeless, and you do not need another hopeless person or negative soul telling you that there is no hope.

No, you do not need another loan or a miracle that helps you pay off your debts completely too. You need mental support, guidance, and the realization that you are your miracle. Only you can pay off your debts, and you have to do this for yourself and by yourself.

Once you start looking for support and words to encourage you, you will learn that Money and debt stress is not only faced by you but by half of the entire population in the world. According to research, the global debt will be 310 trillion USD in 2024. Countries like Japan have the highest percentage of national debt in the world, at 263% of its annual GDP. Imagine that countries are not able to manage their debts, and you are just one person.

I am not saying this to make you feel good about being in debt but to expose you to the fact that even in such times of massive debt stress there are people and families that have overcome debts and become wealthier than ever. Just know that you are not alone in this debt stress and do not feel stuck.

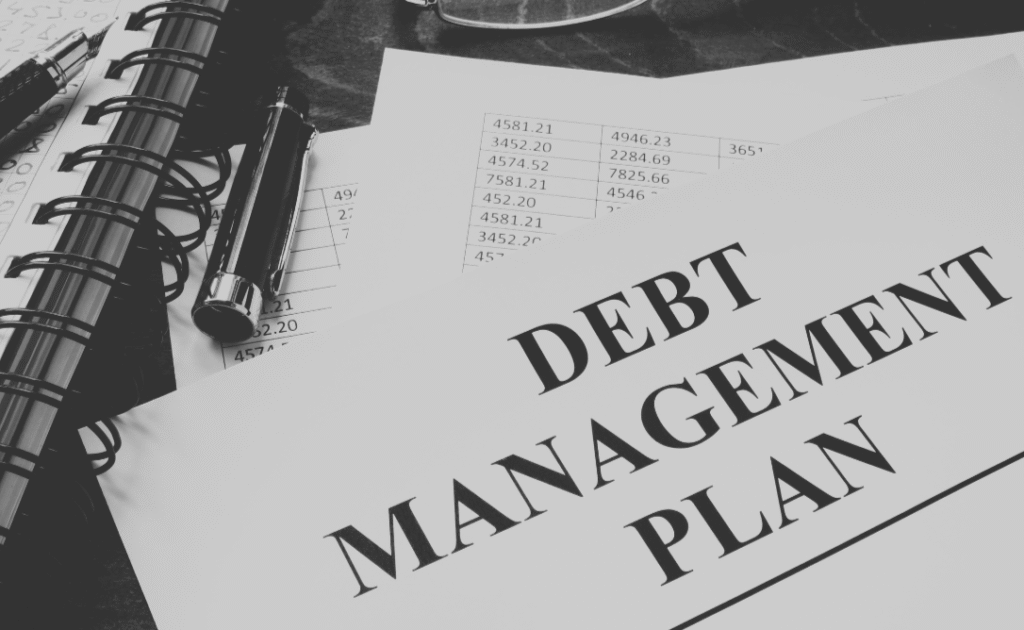

2. Educate yourself on debt management

Watch videos on debt management.

Educate yourself on how to pay off your debts, whether you want to use the snowball technique or the avalanche technique. You will never build wealth until you free yourself from living paycheck to paycheck. If you don’t educate yourself, you’ll end up paying off your debts, only to fall into the trap of debt again

I watched a bunch of testimonials, listened to a dozen money-making podcasts and read a few books to understand how I can break the money stress cycle. Enrol yourself on courses that help you understand money management and learn how to beat money stress.

3. Accept that your lenders don’t give a fuck about your intentions

I know you intend to pay off all the debts, and most of us are even grateful to these lenders for having helped us in our tough times.

This is a great attitude, and it shows that you are a solid human who has a conscience and takes accountability for your actions. Never change this attitude and maintain it at all times. This will help you with your character development in the long run. I as a fellow being know this and relate to it. However, I need you to know that this conscience is overlooked by all banks and other than your intention to borrow more, no other intention matters to your lenders.

The simple reason for your bank to not understand this is; that if they start understanding your intentions to pay off, they will not be able to focus on their intentions of keeping you stuck in the debt cycle. I don’t blame them, but I want to be honest with you. So, if you think your bank will help you pay off your loan. You are delusional.

Yes, once you pay them a lump sum, you will see them help you only to get you hooked on their new lending schemes.

Even financial relief plans are not useful since they’re a way for the bank to keep in touch with you so that you do not run away from their interests. It’s like you are out on bail. I have never been to prison, but I did imagine myself in jail for a few years when I was in debt, so yes, this was the closest word I could think of to explain the financial relief situation to you.

Once you understand how Money stress affects your life and that it’s not just you who is affected by it there is no way a lender would help you go debt-free. You need to now make some real life-changing and wise decisions to become debt-free.

4. How do you motivate yourself and start thinking about paying off your debts?

I need you to know that waiting to be motivated to suddenly start paying off your debts will never happen.

Motivation is a myth.

No, you will not have a million-dollar lottery win, an unexpected bonus credited to your account, or a lender telling you that your debts were paid off, and no, the world is not getting annihilated in the next 10 years at least.

Motivation never helps you start anything. It’s a by-product of starting something, achieving something, and then feeling motivated to do more of it.

To get motivated, Look at your credit card statements. Write down your debts on a sheet and paste it on a mirror. Imagine what it would look like to have zero outstanding on these cards. I used and have been using snowball techniques. In this technique, you list down all the debts you have to pay, and then you make a plan to pay the minimum due on all cards and pay off the smallest dues first.

Once you pay off your smallest due, you will feel accomplished, and this will motivate you to pay off more cards and loans.

This motivation will make you pay the next smallest due, and then the next, and then the next, and then once you pay them all. You will be motivated to save more, live more, and acquire more wealth.

5. Put down all your Money stress on a notepad

Classify which bank and loan are causing you the most stress.

Banks can never understand your intentions and will forward your accounts to collection agencies, who will then chase you to make sure they leave no stone unturned to get their commission.

If you are already in this situation, then speak to the collection agency. Ask them for a settlement, and do not worry about your credit score. If you live and are stress-free, Credit scores can be fixed later. Make a list of items that you do not need and sell them. Sell your old books, and any items that are not needed by you and would not affect the functioning of your life are okay to be sold.

Raise the money for selling these items to pay off your debts. You can always buy these things later, not your freedom from debt.

6. Change your belief about Money

I know a lot of people under debt who watch Law of Attraction videos and can’t wait to attract more wealth, but I don’t see it working for most of them. The reason for that is that in order to welcome something new, we need to first let go of the old.

Yes, a mix of old and new positive beliefs is great; however, we need to prune the negative beliefs about money. The most common negative belief I have seen in people is to say and repeat, I am broke. It sounds pathetic to me. The most pathetic part of hearing it is the conviction they have in their voices. They believe it so much that I can feel their belief hitting my energy chords hard. I think that if you are living, have a heart beating, and have God with you. You can never be broke.

Also, I see people keep saying, for the longest time, Where will the money come from? Or we cannot afford it. Beliefs are nothing but the thoughts we repeat daily. This is another topic of discussion for another day.

From what I am about to tell you, you do not have to know any of the laws of attraction or all the information related to manifestation.

All you have to do is this. Stand in front of the mirror and say this to yourself: You are not alone.

It is just a credit, and you will be out soon. Yes, it will be challenging, but the feeling of being debt-free is worth it. Smile and say, I am ready to be debt-free, and I claim my debt-free life now.

Repeat this every day and now and then. Your mind will slowly absorb the idea of being debt-free, and it will become your mind’s obsession to make you debt-free. You will be guided to education, information, and ways to be debt-free through different channels, humans, and networks.

If you are one of those who say, I am broke, Say, I am abundant and blessed with financial miracles.

Similarly, despite saying, I cannot afford this. I can afford it all, but I don’t need it right now.

7.Be honest and discuss your debt stress with your family

Living alone and fighting debt is less complicated than living with a family, and paying off your debts is not going to be an easy task until everyone is on the same page.

Once you have made up your mind and are ready to pay off your debts, seek help and shamelessly ask your family members for support. Please know that your shame will cost you more of a burden and more future debts if you remain silent and choose to suffer the debt stress alone.

Call all your family members and tell them the truth about how you have been managing their medical, household, and massive expenses, trying your best to be the best for them by going into debt on occasion. Explain it to them how you will be working on a budget and how their support is of top priority and would mean a lot to you.

You have to do this without drama, blame games, or quarrels.

If you are married, despite saying this is my expense, that’s my money, start discussing how earning members can help each other pay off each other’s debts. I had a family meeting with my parent who were understanding of my situation. They did feel bad that I had not told them about it and were under stress for so long. They agreed on the budget I made and even let me move in with them. This saved me rent and I was able to pay the amount of rent towards my small dues.

Some of my friends offered me financial help and some offered me support by just listening to me and being there for me. I am super grateful to have such amazing souls in my life.

8.Understand your needs , wants and prepare a Budget Tracker

Prepare a budget tracker and classify your needs and wants.

Change your grocery stores. Buy from places that are offering super cheap food, and it always seems to be as good as you can get. Make your meal plan. Create a list of cheap food items. Shop generic brands, stop eating out, and stop clubbing. Restaurants have a 300 per cent profit margin.

Learn how to cook. Cancel subscriptions to magazines and premium apps. Ask if what you are buying adds value to your life.

Most of us lack boundaries and do not understand that buying expensive things does not add any value to our lives. Everything that is sold is playing with your emotions. Buying is an emotional decision.

Had a breakup. Let’s buy all the great clothes and make-up and a gym membership, Getting married? Aww, one only gets married once in a lifetime. Buying a big house on a mortgage when all you is a couple of rooms. The Internet is flooded with information on how to have a budget self-care routine, budget wedding and make your living space more spacious without having to buy a bigger house.

Budget will keep you on track and help you live a more financially secure life. Understand your needs and wants. A Need is anything that cannot be overlooked. Want is a desire, and a desire is limitless.

9. Stop borrowing any more money and start saving

A lot of you will have a bad month when an electronic gadget stops working, someone close is getting married, or some unavoidable urgent travel expense may come up. You need to have your money in your savings accounts for such days.

This saved-up money will help you understand and spend wisely since it’s your money and not the lender’s. Also, it will help you to remain disciplined about not using your credit cards in a personal emergency.

No, credit cards are not for emergencies. Credit cards turn everything into an emergency. Remember this!

You do not need to be in debt, even when you have an emergency.

You can use your saved money for all kinds of emergencies and remain free of debt. Saving $1000 is a good amount while you are paying your minimum and smallest dues, and if you can save more, saving for a 6-month new budget is the next step.

10.Build a side hustle

Turn your hobbies into a side hustle; if you know anything other than the job you do, offer the service online to generate a side income for you. I write freelance and also manage this blog to make sure I am building a community of like-minded people. Sharing my learning is how I give back to the Yourpsychosis community.

I still have not gotten this blog monetized, but I won’t hesitate to do so the day I meet my goal of seeing this blog add enough value to my reader’s lives.

Build something on the side, as it will keep you engaged in times when money stress starts eating you.

You can do part-time jobs Delivering food, babysitting, and doing customer service jobs from home. There is a lot of work out there that can keep you busy and make you money in return for a skill. Take time and once you know what you can offer. Get started fast.

11.Learn to unlearn your old buying habits

If you have worked in sales then you will know that buying is an emotional decision.

I suggest you try this: Add things to your cart, forget about it, and visit the cart in a month. You will realize you did not even want any of these things in the first place. It was recommended to you by the system, and you were being emotionally forced by advertisements and recommended articles to make that purchase. I once bought an electric kettle and an egg beater that I have not used to date since I still use a manual egg beater.

And No, you do not need a Gucci bag, a Jimmy Choo, or even a heavy nighttime beauty regime and a costly make-up and an expensive watch to watch the time when your phone already has a clock showing you the times of all the zones that exist on Earth.

Become self-aware and ask yourself: Why do I need a shoe that does the same job as any other shoe? Okay, I understand that it adds to your dressing statement, which is fantastic, but did you ever search and make yourself aware that a similar-looking shoe is available at random stores for a much cheaper price?

If you think not spending a great amount of money on clothes is going to make you appear less confident, then you need to ask yourself: What is more important, your fake confident looks bought on credit cards or the confidence you have when you have savings, education, stability, and freedom?

If your answer is the latter one, then you are already aware and are making decisions to secure your future.

Also, to be confident in your looks, invest in clothing that complements your personality and keep it simple and classic rather than going nuts over trendy and what’s new. This habit will make you more known for who you are than for what you wear. Celebrate being non-traditional and uniquely dressed.

I do not follow fashion trends but have always invested in quality and simple clothing I need. I saved for months to buy myself my new trekking shoes because I enjoy trekking.

You can apply the same awareness to your impulse buying of jewellery, bags, gadgets and so on.

12.Stay true to your imagination

Keep imagining the feeling of paying your first and last debt.

Oh my god! I know how it feels to pay off my first debts. It feels like a little band-aid that my financial wound finally got. It feels awesome, my friends, and I know you can do it. I believe if I can do it, you can too.

Have an emergency fund for yourself. Once you pay off your debts and have your confidence back, you can be generous to others. This would create a margin for yourself and put you in a position to help someone like you in need and return the favor. It’s good to offer prayers to your friends, but how amazing would it be to offer them some money sometimes?

Margins make you start living a more meaningful life, experiencing abundance and money-blessing days.

Imagine yourself shouting, I am debt-free and will stay debt-free.

I send you all a financial abundance of energy, and please, please, do not let go of your vision of being debt-free soon.

—Love, G

Geeta, who likes to be called G, when not working, can usually be found reading a book, spending (perhaps a little too much) time meditating, practicing yog, or just vibing in the present moment like a mindfulness pro. And—despite claiming she knits very badly—she still picks up the needles now and then. Blogging to share her life learnings is her passion!